When I first got my LEAF, and folks asked me about my carbon footprint, I told them that by charging after midnight in CA my car was often drawing surplus wind power. I could claim my carbon footprint for charging in my garage was near zero.

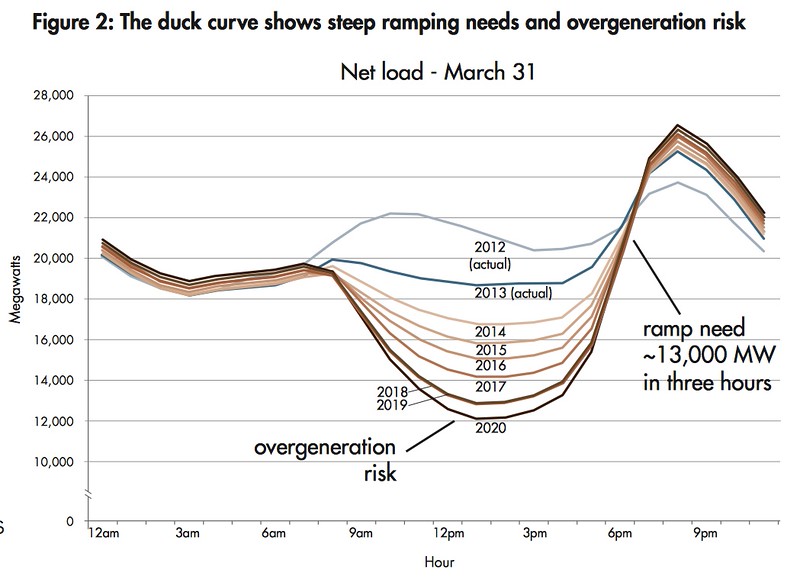

With the advent of the large new grid-scale solar projects in the desert the last few years, including the monster thermal tower project at Ivanpah near the NV border and Primm, the daily production curves are showing dramatic change. CAISO (California Independent System Opeator) is now talking about the Duck Curve, which plots the expected difference between total load and production from variable production sources, including solar and wind:

The total production of grid-scale solar in CA is now over 5 GW for several hours near midday. Much of the grid-scale solar tracks the sun, so it has a nearly trapezoidal power distribution that ramps up rapidly in the morning and declines rapidly in the late afternoon. Our own individual residential solar adds another 1.2GW of capacity, plus about 1 GW of non-utility commercial solar installations, but CAISO sees these latter two only indirectly as reduced demand from its member utilities. These non-grid-scale installations are mostly non-tracking, so their power curves are more bell-shaped.

CA has well over 5 GW of installed wind power capacity, but because the winds are variable, production often peaks at less than 1.5 GW.

More grid-scale solar is planned for CA, but projected increases in wind power are much more modest. The reverse is true on the national scale, where wind power has jumped to an impressive 4% of total production in just a few years. Wind is over 25% of Iowa's production (but 60% is coal).

The above graph projects that conventional production, which is now largely natural gas, will often reach a minimum in the afternoon, not overnight. However, the example shown is for March, and total demand in the summer is higher, typically 45 GW, so the summer minimum may still occur at night.

My conclusion is that for at least part of the year the lowest-carbon time to charge our cars may move to late morning or afternoon. It will be interesting to see if and when incentives are tilted in that direction. EVs used for commuting will need a lot more charging available at work locations.

CAISO is worried that it will be difficult for the sources it controls to ramp up and down to match the Duck Curve. Eventually with deep solar supply we are going to need grid-scale storage, which I will discuss in another post.

With the advent of the large new grid-scale solar projects in the desert the last few years, including the monster thermal tower project at Ivanpah near the NV border and Primm, the daily production curves are showing dramatic change. CAISO (California Independent System Opeator) is now talking about the Duck Curve, which plots the expected difference between total load and production from variable production sources, including solar and wind:

The total production of grid-scale solar in CA is now over 5 GW for several hours near midday. Much of the grid-scale solar tracks the sun, so it has a nearly trapezoidal power distribution that ramps up rapidly in the morning and declines rapidly in the late afternoon. Our own individual residential solar adds another 1.2GW of capacity, plus about 1 GW of non-utility commercial solar installations, but CAISO sees these latter two only indirectly as reduced demand from its member utilities. These non-grid-scale installations are mostly non-tracking, so their power curves are more bell-shaped.

CA has well over 5 GW of installed wind power capacity, but because the winds are variable, production often peaks at less than 1.5 GW.

More grid-scale solar is planned for CA, but projected increases in wind power are much more modest. The reverse is true on the national scale, where wind power has jumped to an impressive 4% of total production in just a few years. Wind is over 25% of Iowa's production (but 60% is coal).

The above graph projects that conventional production, which is now largely natural gas, will often reach a minimum in the afternoon, not overnight. However, the example shown is for March, and total demand in the summer is higher, typically 45 GW, so the summer minimum may still occur at night.

My conclusion is that for at least part of the year the lowest-carbon time to charge our cars may move to late morning or afternoon. It will be interesting to see if and when incentives are tilted in that direction. EVs used for commuting will need a lot more charging available at work locations.

CAISO is worried that it will be difficult for the sources it controls to ramp up and down to match the Duck Curve. Eventually with deep solar supply we are going to need grid-scale storage, which I will discuss in another post.